There is a fierce debate in Washington policy circles and on Wall Street these days as to whether the tariffs President Trump is so eager to impose on foes and allies alike will be inflationary. There is also an ongoing question as to what Trump seeks to achieve: Bargaining leverage for some unrelated goal (eg reducing Canada’s negligible Fentanyl exports to the US); revenue raising for the US Treasury; or a more equitable balance of trade with other countries.

When questioned by journalists as to who will ultimately pay for these surcharges, Trump always insists it will be our foreign counterparties. This is obviously untrue and Trump should understand this about as well as he understands that Biden won the 2020 election. But what if the President has an ulterior political motive?

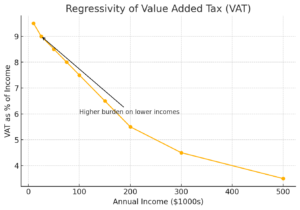

It has long been debated whether the US should raise part of its revenues through a Value Added (VAT) or consumption tax. Policymakers have resisted this because it is so demonstrably regressive in its application. I.e., as shown in the chart below, lower-earning Americans would pay a much higher proportion of their incomes on necessary goods than higher earners.

Thus, it would not be good populist politics to cut healthcare and other social services, reduce taxes on corporations and high earners, and pay for this with a regressive consumption tax on those least able to afford it.

Like so much of the MAGA cultural agenda, VAT-cum-tariffs are another magician’s slight of hand to distract the mark.

Originally posted on Substack at https://open.substack.com/pub/tomglocer/p/tariffs-are-a-vat