I am regularly asked to speak on various corporate governance topics. Perhaps this is not surprising since I have sat on public company boards in the US, Canada, France and England and multiple private company and charitable boards. Add to this three years of law school, 10+ years practice as a corporate lawyer, and a decidedly nerdy approach to lifelong learning, and no one is awaiting my thoughts on the Taylor Swift/Travis Kelsey romance.

Typically, I get asked to speak about relatively narrow issues such as how a public company board should organize cyber defense oversight, how to run an effective CEO succession, or how to manage board refreshment, diversity and experience.

Today, I want to write about two important principles that should not be incompatible, but all too often are: Governance and Investing. I firmly believe that robust corporate governance, including exacting board oversight, is a core component of long-term value creation. However, at many large asset managers, evaluation of board governance and proxy voting are separated from portfolio management and performance measurement. I, of course, understand the attraction of job specialization as well as the already heavy workload on portfolio managers and analysts, but the best investors understand that governance is not a separate function focused on achieving political goals but rather an intrinsic and vital aspect of investing itself.

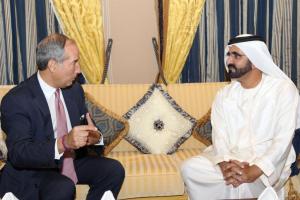

Sometimes it is hard to see the economics of the forrest for the governance of the trees. An episode from my years as CEO of Thomson Reuters can serve to illustrate this point. Thomson Reuters is a Canadian corporation, majority owned by Woodbridge Company, which serves as the holding company for the Thomson family. In the lead-up to our 2010 Annual Meeting of Shareholders, I received a letter from the head of Corporate Governance at a mid-sized UK asset manager, regretfully informing me that the firm could not vote in favor of our compensation proposals because the firm had a policy of voting against any proposal adopted by a compensation committee that included a non-independent director.

Now, on its face, this policy not only accords with generally accepted governance principles but makes good sense. However, in the case of Thomson Reuters, the non-independent director in question happened to be the President of Woodbridge, our majority owner. So, think about this for a moment on a purely rational economic basis. For every $1.00 of compensation the committee agreed to pay management, Woodbridge would (in economic substance) be paying 55 cents. While it is true that the Woodbridge director was not independent given their large ownership position, this was not an example of a conflict necessitating the exclusion of this non-independent director.

My conclusion would be different if, for example, the Woodbridge director were included on a special committee considering a going-private transaction. There the conflict would be obvious. The reason I belabor this example is that in my experience there is a huge amount of non-economic, fuzzy thinking on governance matters, and it is too important an aspect of investing to ignore. Shareholders should be delighted that the majority owner was involved in setting executive pay; their interests are aligned and none of the classic agency problems associated with fragmented ownership are present.

I was so confused by the letter from the UK investor that I called him to politely explain why he should not worry about the Woodbridge director voting on compensation plans, because he, above all other directors, was motivated to limit executive pay to the minimum needed to retain and motivate management — i.e. he had real skin in the game. We proceeded to have a very pleasant conversation about agent vs. principal conflicts and how these translated to the public company context. All to no avail. As I have so often heard in my professional life he simply demurred, stating he had enjoyed our exploration of governance principles and their economic bases, but they had a policy against non-independent directors serving on compensation committees.

As Ralph Waldo Emerson wrote, “A foolish consistency is the hobgoblin of little minds.” Voting policies should be rules of thumb, not strait jackets for the evaluation of proposals that may or may not be in the long-term best interest of the corporation and its shareholders. The separation of proxy voting from portfolio management at large investors should permit the division of labor and greater specialization, not the separation of governance from long-term investment objectives.